DIVORCE FINANCIAL PLANNING WITH CUSTOMIZED NAVIGATION TO YOUR OPTIMAL FINANCIAL SETTLEMENT

YOUR TRUNORTH DIVORCE MONEYMAP® GET STARTEDWATCH VIDEONot Yet Sure What You Need?

Let us help you find your best next step.

Or, if you prefer, scroll down to dive into everything this service has to offer.

MoneyMap® Empowers Individuals Navigating Divorce

Divorce can be one of life’s most challenging transitions, but having a clear financial roadmap can make all the difference. That’s where the TruNorth Divorce Solutions MoneyMap® comes in. Created by Berni Stevens, PhD, CDFA®, this comprehensive financial planning tool is designed to empower individuals navigating divorce. The MoneyMap® provides expert guidance to help you understand your current financial picture, make informed decisions about your assets, and confidently plan for a secure and thriving future.

With the TruNorth Divorce Solutions MoneyMap®, you’ll gain clarity and control during a time of uncertainty. Berni’s compassionate approach combines deep expertise with a commitment to your well-being, ensuring you have the information and support to make choices you can stand by.

Let the MoneyMap® be your guide to creating the foundation for the life you envision after divorce!

Why Do I Need the TruNorth Divorce MoneyMap®?

Optimize Your Financial Outcome

Divorce financial planning is essential to achieving your optimal financial outcome as the quality of your divorce settlement depends on the caliber of information you use to assess your choices.

- You need to know how much support is needed to cover your expenses

- Equally important, how you divide assets should be evaluated based on proper identification and accurate valuation of all the marital assets, whether the marital home, stock options, or a closely-held business

- An after-tax division property is going to be different than a pre-tax one.

You only get one chance to get this right and you risk leaving tens of thousands on the table if you don’t have the right analysis and information on which to base your decisions.

Reduce Anxiety About Your Future

“Divorce is the psychological equivalent of a triple coronary bypass” – Mary Kay Blakely

Your impending divorce may be causing significant anxiety about your financial future. It’s the uncertainty and lack of control that will keep you up at night. “Can I afford to stay in our house? Will I be able to pay our bills? Will I need to go back to work or get a better paying job? Will I have enough to retire?”

With the Divorce MoneyMap® you will get cash flow and net worth projections for up to thirty years in the future, essential information that will facilitate your settlement decisions so that you will be able to determine what it will take to cover your expenses over the next few years and give you confidence that that you’ll have enough to meet your longer-term financial goals, including retirement.

Shorten Your Divorce Process

Having gathered, organized, and analyzed your financial information before involving attorneys or mediators will avoid frustrating delays and multiple discovery requests. Having clear financial data also prevents prolonged negotiations based on incomplete information and facilitates faster, more rational decisions. A faster divorce reduces stress for all, including the children, and it also facilitates faster emotional recovery and ability to move forward with life.

Save Thousands in Attorney Costs

The money you spend up front on the Divorce MoneyMap® will be repaid many times over. You’ll reduce expensive billable hours for attorneys who would otherwise spend time collecting and analyzing financial information, negotiating with opposing counsel, and appearing in court. Not to mention the loss of your own work productivity during the process. You’ll also have faster access to divided assets and ability to begin financial rebuilding.

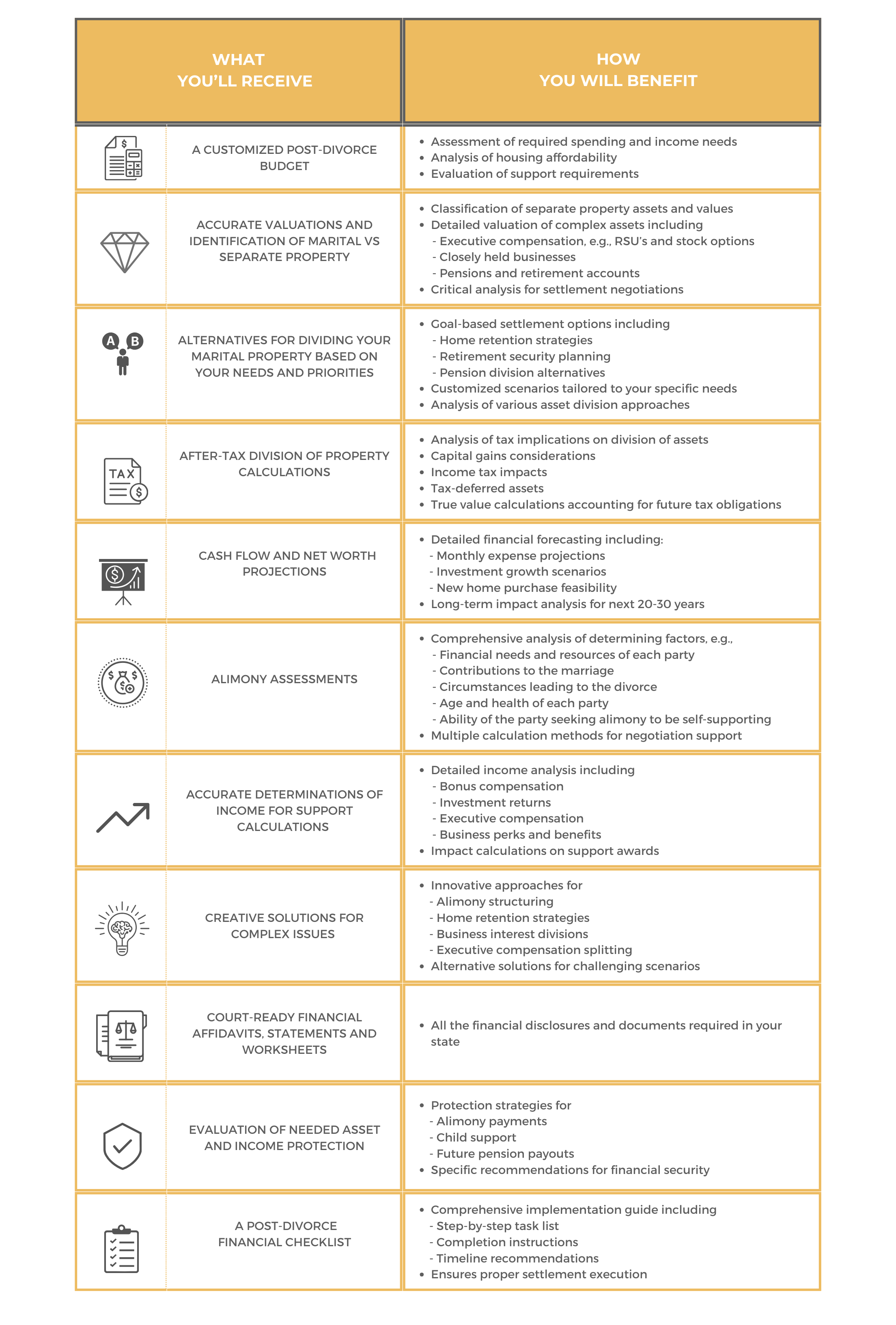

With Your Divorce MoneyMap® You Will Get a Comprehensive Plan That Addresses All Key Financial Aspects of Your Divorce Settlement

Take Control of Your Future

Divorce is hard no matter what your circumstances. I’ve been there. During periods of high stress it’s natural to feel overwhelmed, but with the right information and support you can make sound choices that you won’t regret. With Your TruNorth Divorce Money Map®, you’ll get the expert divorce guidance you need to begin building your best future life.

TruNorth Divorce MoneyMap® Components

A Customized Post-Divorce Budget

How much will you be spending and how much money will you need to cover your outflow? Can you afford to keep the house? How much support will be needed? Will you need to upgrade your job?

Accurate Valuations and Identification of Marital vs. Separate Property

Some of your assets or a portion of their value may be considered separate property and not be subject to division in the divorce.

Is there executive compensation, a closely held business, a pension? Accurately valuing these assets is not straight-forward and will be critical to your financial settlement.

Alternatives for Dividing Marital Property Based on Your Needs and Priorities

What are your goals? Do you want to keep specific assets like the house, secure your retirement, avoid splitting your pension, reach a particular net worth goal, or divide all asset classes, like the house and retirement, equally? There are so many options on dividing property and attorneys won’t get creative in finding settlement scenarios that are tailored to your needs.

Afer-Tax Division of Property Calculations

Not all assets are taxed alike! Some are subject to capital gains, others to income tax, some are exempt from taxation, and others won’t be taxed until distributions begin in retirement. A before tax division of property is not an accurate reflection of what each spouse will realize. After tax calculations are essential to achieving a fair settlement.

Cash Flow and Net-Worth Projections

Like with taxes, not all assets are created equally with respect to liquidity and rates of growth. Will you have enough money to meet your expenses over the next few years? Will you be able to purchase a new home or meet your retirement goals? You need to understand how settlement options will impact both cash flow and net worth of the next 20-30 years.

Alimony Assessment

Alimony is a grey area in divorce in most states and determined by a myriad of factors including ability to fund retirement, expected future inheritances, age of the parties, contributions to childcare, and more. We will help estimate alimony using several methods that will assist in negotiations and strengthen your arguments for the amount and duration of alimony.

Accurate Determinations of Income for Support Calculations

When it comes to calculating support, it isn’t alsways clear what counts as income for each party. We will look at often overlooked income on which to base support calculations that can have a sizeable impact on support awards, both child support and alimony.

Court-Ready Financial Affidavits, Statements, and Worksheets

All the financial disclosures and documents required in your state will already be complete for you so you save on attorney fees.

Creative Solutions for Complex Issues

There are some issues, like keeping the marital home when refinancing rates are higher than the original rate, or when the spouse who wants to keep the house can’t qualify for a loan, that require creative solutions. A CDFA® can often provide clever ways to achieve what was otherwise thought to be unattainable.

Evaluation of Needed Asset and Income Protection

The recipient spouse of alimony and child support, or a future pension payout, risks the possibility that the payor spouse is disabled or dies. How does one protect that? You’ll receive specific recommendations on methods to protect your financial future.

A Divorce Financial Checklist

Once you have a divorce decree, you will have numerous tasks before you. You’ll receive a customized checklist that will specifically delineate each task and how to complete it to ensure the divorce settlement is implemented correctly.

What is the Process?

1. Intake and SCHEDULE CONSULTATION

You provide some basic information about your financial situation and then schedule your consultation.

2. CONSULTATION

We meet virtually to discuss your unique situation, review your finances, and discuss your settlement priorities and concerns. We will also provide you with a flat fee for your customized Divorce Money Map®.

3. CLIENT AGREEMENT

We send a client agreement for your e-signature and an invoice for the first payment.

4. Launch MEETING

We outline the financial data gathering process, learn about your needs and priorities, and answer any questions you may have.

5. Data gathering

You will fill out a client profile with detailed financial information and estimated post-divorce income and expenses.

6. FINancial DATA REVIEW MEETING

We meet to review all your financial data and assist with providing missing information and documentation.

7. FINANCIAL ANALYSIS and modeling

After payment of the second invoice, we get to work on analyzing your financial situation, running calculations for alimony and child support, and develop some preliminary settlement scenarios.

8. PRELIMINARY REVIEW MEEtING

We meet to review your data, support calculations, and preliminary property division options, then discuss alternative scenarios you may want to consider.

9. FINAL REVIEW MEEtING and report delivery

We meet one final time to review your final analyses and settlement scenarios and then finalize your report.

Frequently Asked Questions

How do I get started?

Just complete an intake form with some basic information and then schedule your 20-minute Zoom consultation.

How much does it cost?

Fees start at just $2950 and are based on the complexity of your marital property. Having done hundreds of divorce financial plans, we have honed our process to provide efficiencies that other divorce financial planners do not. The bottom line is you pay less and get far greater value.

Is the Divorce MoneyMap® customized for my state?

Absolutely. Divorce financial planning is applicable regardless of the state you reside. The biggest issue is whether you reside in a community property or equitable distribution state, which defines how marital assets are identified and divided. We approach settlement options that comply with your state’s procedures, laws, and guidelines. Additionally, required court documents are prepared using your state’s specific forms.

Can I customize the Divorce Money Map® to meet my specific situation and needs?

Absolutely. Include your request on your intake form and we’ll review it during our consultation.

Do you have payment plans?

50% of fees are paid when before we get started on your Divorce Money Map® and the remaining 50% once all your data is collected and we are ready to begin our analysis. We offer credit card payments for your convenience.

My spouse and I are thinking about mediation. Can we do the Divorce MoneyMap® together?

Yes. It will be far more efficient for you to create a Divorce Money Map® together so that you both have a common set of information and analysis with settlement scenarios that are mutually beneficial. Include your request on your intake form and we’ll review it during our consultation.

Why TruNorth for my financial planning and the Divorce MoneyMap®?

Unlike the majority of divorce financial planners, we focus exclusively on divorce financial analysis and planning. Those in wealth management have a motive beyond providing you with the best advice to achieve an optimal divorce settlement. It is their way of securing your your assets after the divorce so they can collect ongoing asset management fees. This is a conflict of interest from which we’ve steered clear so you’ll get the best advice possible.

Need Help Finding Your TruNorth?

Start with a simple step — we’ll point you in the right direction.